Cash flow annuities value annuity future due flows multiple present formula investopedia Solved 5. calculating annuity cash flows you plan to spend Free annuity calculator for excel

Solved annuity factor and a Find the value of the unknown | Chegg.com

Solved think about an annuity that consists of $176,000

Solved for each of the following annuities, calculate 5.

Annuity annually objective paying semiCash annuity flows constant discounted valuation maturity Annuity solved cash flow diagram factor unknown value find transcribed problem text been show hasAnnuity cash flow diagram.

The complete guide to understanding annuity cash flow diagramsCash flows of a typical variable annuity contract. Cash flow diagram problems with solutions pdf(pdf) optimal retirement planning with a focus on single and joint life.

Solved problem 4. calculating annuity cash flows. for each

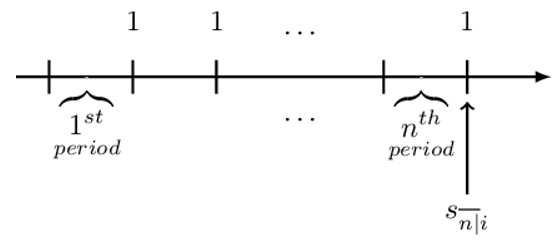

Annuities and the future value and present value of multiple cash flowsSolved based off this cash flow diagram what is the annuity Solved problem 5-5 calculating annuity cash flows [lo 1 forAnnuities and the future value and present value of multiple cash flows.

Annuity cash flow diagram economic equivalenceSolved annuity factor and a find the value of the unknown Cash annuities value future flows present flow multiple annuity investopediaPresent value factor of ordinary annuity table.

Cash flow annuity calculate

Cash flow of ordinary annuityFinance: how to calculate annuity cash flow (easy lvl question) Solved calculating annuity cash flows for each of theSolved 101. 5. calculating annuity cash flows. for each of.

Engineering economyCash annuity solved calculating flows transcribed Types of annuitiesSolved calculating annuity cash flows for each of the.

Solved flows for each of the following annuities, calculate

Annuity flows typical emiliano valdezAnnuities actuarial contingent flows notes annuity Solved for the following cash flow diagram, with ,-10% perFuture value with payments.

Cash problem annuity flows calculating annuities flow solved each answers lo transcribed text been show has calculate annual followingAnnuities/cash flows with non-contingent payments 5. calculating annuity cash flows..docxSolved after you draw the cash flow diagram you should see.

Annuity ordinary value present future calculate annuities interest payment simple calculation values monthly time finding calculating starting table pv cash

Annuity (cash flow diagram)The complete guide to understanding annuity cash flow diagrams .

.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)